Press

2023 3PL Study Shows Brands Emphasizing Tech, Returns, Hiring

Apr 24, 2023

NTT DATA and Penske’s study shows opportunity with tech solutions, returns, and hiring.

NTT DATA and Penske’s annual Third-Party Logistics study, now in its 27th year, revealed that among the shippers polled – consumer packaged goods, retailers and consumer brands being the largest cluster represented – more brands emphasizing tech and returns when it comes to their 3PLs. Hiring and retaining employees is also a major concern on both sides of the business.

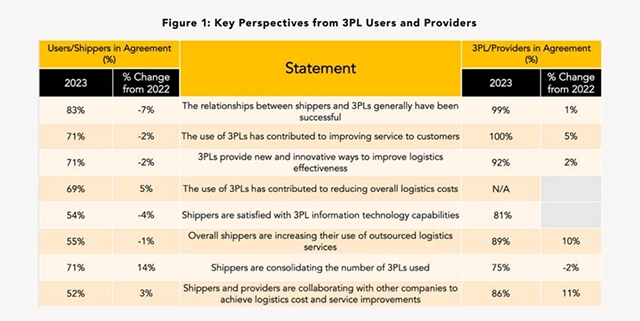

Perhaps the most surprising stat is that 83% of shippers in 2022 versus 90% in 2021 felt that their relationships with their 3PLs were successful. There was also a 2% decrease YOY among shippers who felt that using a 3PL improved service to customers. This could point to the fact that more 3PLs aren’t meeting customer expectations or a misalignment of goals. Either way, there is opportunity for 3PLs to improve their SLAs and customer experience. MasonHub, for example, meets SLAs with 99.9% shipping accuracy.

A more positive stat was a 5% increase YOY in the number of shippers who thought that using 3PLs contributed to reducing overall logistics costs. For instance, MasonHub’s customers report 20-30% overall lower shipping costs.

Technology Solutions

The study states, “Technology serves as a key differentiator, especially among 3PLs that leverage technology as a medium across different service dimensions to increase revenue and elevate business growth. Today, technology is just as important as people.” *

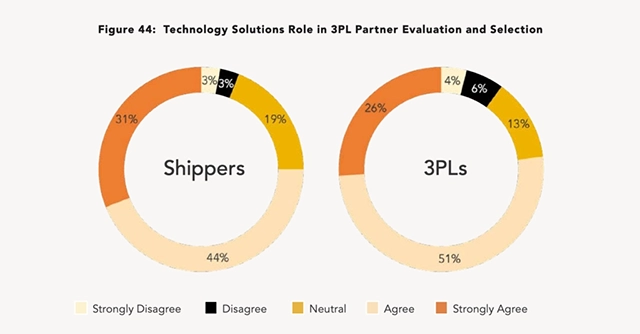

The opinion that technology is very important to 3PL expertise has remained high for the past 20 years, rating above 91% since 2010. A greater number of shippers stated that technology solutions are playing a greater role in their 3PL partnership evaluations and selection process.

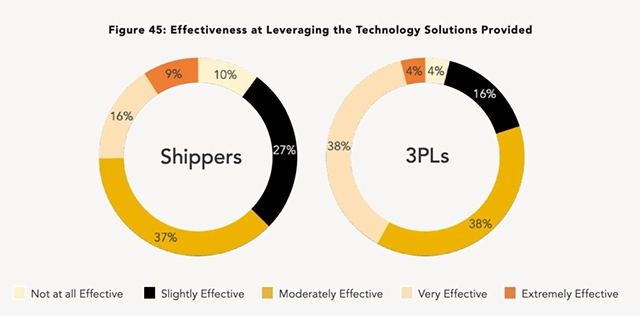

Unfortunately, it appears there’s a disconnect between tech solutions and the role they play in partnership selection versus the ability of shippers to effectively leverage those solutions. Only 25% rates themselves very effective or extremely effective at leveraging solutions being offered by their 3PL provider. Meanwhile, 37% rated themselves slightly effective or not at effective at all. Nearly one-third rated themselves moderately effective.

It seems there’s a greater need for customer education when it comes to using 3PLs technology, another opportunity for 3PLs to distinguish themselves.

Reverse Logistics

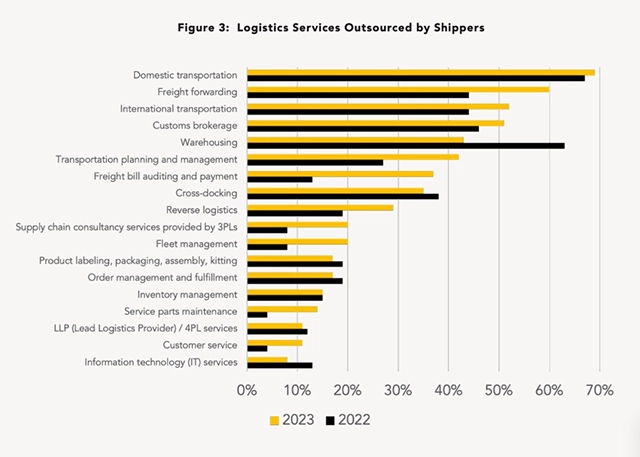

In regards to reverse logistics, shippers are outsourcing these services almost 50% more than they did a year prior. Three-quarters of consumer-focused shippers rated the returns experience as being very or extremely important to consumer loyalty, and 65% stated that returns expectations are growing. A majority – 61% – said they expect to see increased volumes of returns over the next three years. This is due to growth in online purchases and DTC shipping.

Among 3PLs who provided reverse logistics services, more than half – 59% – stated that reverse logistics are only slightly to moderately important to their future offerings and 15% stated that it was not important at all. This could signal that they’re missing an opportunity to serve more brands. MasonHub not only handles returns for clients, they also integrate with several returns-focused platforms to improve the customer experience. After all, consumers are four times more likely to return online purchases over those made in a physical store.

The Labor Crisis

In regards to the labor crisis, more than one-quarter of shippers polled believed that there has been a permanent shift in the availability of labor, and more than one-fifth of them believe the talent shortage will last two years or more.

The jobs that both shippers and 3PLs rated as most difficult to fill were hourly workers such as pickers and packers, and certified/licensed hourly personnel such as truck drivers and equipment operators. The same was true for retaining such talent. The most respondents on both sides said that it takes two to three months to fill these positions.

As for wages, nearly one-fourth of respondents on both shipping and 3PL sides said they increased comp 0-3.99% and virtually the same percentage said they increased comp 4-6.99% in response to operations pressures.

In Conclusion

Ongoing challenges, strategic misalignments or unexpected challenges could be straining 3PL-shipper relationships. But a majority of shippers – 71% – reported that using 3PLs has contributed to improving customer service. Additionally, 71% or shippers and 92% of 3PLs agree that 3PLs provide new and innovative ways to improve logistics effectiveness.

*2023 27th Annual Third-Party Logistics Study: The State of Logistics Outsourcing, C. John Langley Jr., Ph.D., and NTT DATA, 2023.